Macroeconomic Situation in the First 2 Months of 2024

- In February, inflation increased by nearly 4% compared to the same period last year, primarily due to the Lunar New Year falling in February this year (while it fell in January last year). The average CPI for the first 2 months of the year only increased by 3.7%.

- Export activities showed positive developments in the first 2 months of the year with a growth rate of 19.2% YoY. Major export items saw impressive increases: electronics (24%), machinery and equipment (25%), textiles (15%), iron and steel (63%), etc. The US and European markets increased by 34% and 14.2% respectively, while China only increased by 7.7%. Overall, Vietnam achieved a trade surplus of $4.7 billion USD in the first 2 months.

- Manufacturing activities also showed resilience with the PMI index consistently above the 50 threshold in the first 2 months of the year. However, the number of new export orders remained stagnant in February after a strong increase in January.

- The disbursement rate of public investment reached 8.7% of the total plan. Compared to the government’s assigned plan, the disbursement rate reached 9.13%, an increase compared to the same period in 2023 (6.55% of the total plan and 6.97% of the government’s assigned plan).

- Newly registered FDI reached $3.6 billion USD, an increase of 55.2% YoY, while realized FDI reached $2.8 billion USD, up 9.8% YoY. Notably, the amount of new registration surged in the month due to positive news such as Dong Nai province attracting nearly $500 million USD of investment into industrial parks in the first 2 months.

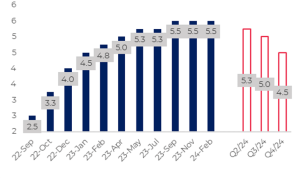

USD/VND Exchange Rate and USD Index Trends

The market has shifted expectations for the Fed’s interest rate cuts from Q3/24 to Q6/24 with a lower reduction rate than before.

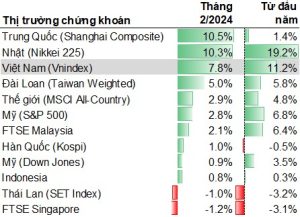

Stock Market Trends

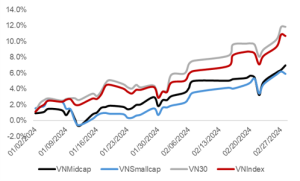

The VNIndex closed February 2024 at 1252.7, up 7.8% since the beginning of the month and 11.2% since the beginning of the year. February also marked the fourth consecutive month of positive growth for the Vietnamese stock market. The recent positive growth trend of the Vietnamese stock market has been primarily supported by:

- Improvements in macroeconomic conditions along with stimulus policies to boost economic growth from the beginning of the year;

- Expectations of the US Federal Reserve (FED) reducing interest rates in 2024;

- Low VND deposit interest rates stimulating funds to seek more attractive investment channels.

Forecast for March 2024 Stock Market

We believe that the recent positive information supporting the stock market has been fully reflected. Therefore, we believe there is a high possibility that the market will reverse in March due to the impact of factors including:

- Recent US inflation data is decreasing slower than expected, so the FED may maintain high interest rates for a longer period, with the focal point being the FED meeting on March 20. Therefore, global stock markets are likely to reverse in anticipation of the FED’s decision.

- Domestically, the trial of major cases scheduled for this month may exert pressure on the market amid a lack of positive information.

- Exchange rate pressure still exists as the USD/VND exchange rate has surged recently. Despite forecasts of FED interest rate hikes, the USD’s strength index has continued to increase. Combined with seasonal factors, the USD/VND exchange rate rose to 24,500 – 24,600 by the end of February, the highest level in nearly a year.

Conversely, positive information supporting the market in the near future includes: exports still maintaining positive momentum, the operation of the KRX system, and low deposit interest rates continuing to stimulate funds flowing into the stock market.

Based on the above factors, we forecast that the VNIndex could return to the range of 1180 – 1220 in March. Key factors to watch are exchange rates, information regarding the FED’s interest rate decision on March 20.

Research team, Red Capital